Online banking is a great tool for people who want to access their bank statements and pay bills from the comfort of their couch. However, it can’t help one categorize their expenses or establish their budget. This is where financial tracking software comes in and enables you to get a handle on how much you spend, how you owe, how much you have, how much you save or how you spend money differently in future. In this post, we review the best personal finance software options available on the market. The ranking comparison of these software is based not on price, but their functionality and ease of use.

Best Personal Finance Software

1. Mint

With more than 20 million registered users, Mint is first on the list of best personal finance software. It is known for offering outstanding features. Whether you want to know how much you need to put aside each month to afford an exotic holiday or have a huge expense that is due every few months; Mint can help you. The software understands that life requires flexible spending, hence the “Everything else” category. Newbies to personal finance software will find this program incredibly easy to use since everything is on one page rather than on a drop down menu.

Pros

- Easy to use.

- Ability to connect to your bank accounts, home loan, auto loan, student loan, IRA, 403(b), 401(k), and more.

- It lets you set financial goals.

Cons

- It has a lot of banner ads.

- It takes a while to set up Mint.

- There are a lot assumptions about your budget that you have to change manually.

2. Personal Capital

If you are not big on keeping budgets and have irregular spending habits, Personal Capital will prove useful. People who have to deal with unpredictable paychecks and business travel will certainly appreciate what this best personal finance software has to offer. It allows one to see whether they net worth is going up or down, how current expenses and income compare to previous months as well as where their money is going.

This free, browser-based software along with its mobile app are best known for the intuitive and attractive design. The dashboard gives you an overview of your cash-flow and net worth while the drop down menu allows you to view detailed analysis of your transactions.

The program places great emphasis on investments. It tells you, in percentages and real dollars, by how much your investments have gone up or down. In addition, Personal Capital lets you know whether major indices like S&P 500 and Dow Jones have lost value, thus allowing you to better manage your investments.

Pros

- Setup only requires you to link accounts and categorize your transactions.

- It is perfect for people with unpredictable expenses that make it hard to budget.

- Personal Finance is incredibly easy to use.

- It allows you to manage investments.

Cons

- It is only available to US users.

3. You Need A Budget (YNAB)

Like the name suggests, You Need A Budget is all about budgeting. Unlike Personal Capital and Mint, you will not be able to connect your mortgage or 401(k) and neither will you be able to track your networth. The only thing you’ll do is take every dollar and give it a job, as YNAB puts it. This means taking every dollar you earn and figuring out how you will spend it starting with the most immediate expenses. It is the best personal finance software for someone with many recurring expenses and a stable income.

Pros

- You can only spend what you have earned. YNAB doesn’t let you budget for any paycheck that is yet to hit your account.

- The software doesn’t let you go over the budget. If you spend more than budgeted for in one category, the app reduces expenses in another category.

- It encourages one to plan for future by making you to think of extra money as something you can put towards future expenses.

- The free webinars are super useful.

Cons

- It doesn’t have a free version.

4. Quicken

Next up is on the list of the best personal finance software is a downloadable personal finance software that is owned by Intuit and which has been around for decades. Much of its basic functionality is similar to that of Mint, but it is designed for more experienced users. It doesn’t teach one how to set financial goals. Being a paid program, you don’t have to worry about banner ads on the dashboard found on Mint.

Pros

- No banner ads.

- It is extremely comprehensive with a variety of tools required for personal finance.

- Being an established program, many investment sites, banks and payee have familiarity with the system. This makes synchronization easier.

- One can integrate other Intuit products such as Quickbooks and TurboTax with Quicken.

- The mobile app allows you to make decisions on the go.

Cons

- It requires paid upgrades.

- There is no 24/7 support.

- Some of the versions, especially Quicken 2015, are buggy.

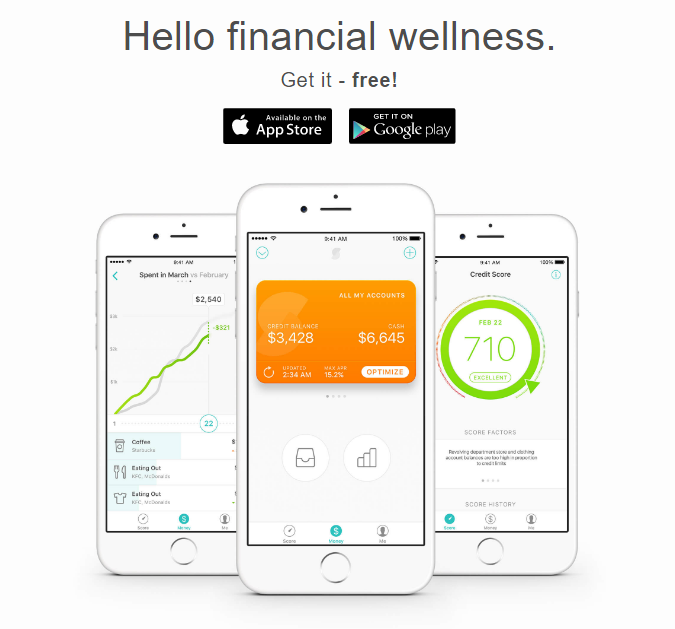

5. Prosper Daily

Te last in the roundup of the best personal finance software is an Android and iTunes app that is designed to help users track expenses by category. You can also flag any transaction that appears fraudulent. Despite being light on features, you can still compare the spending of the current month with those of last month. Like Personal Capital, this is an excellent option for those who aren’t big on budgets.

Pros

- It is easy to use.

- Ideal for tracking how money is spent and hence your net worth.

- It is cheap.

Cons

- It is not the best option for tracking expenses.

Final Thoughts

Whether you need to track personal expenses, income, investments or budget for the future, the above finance software have you covered. Each of them is geared towards specific uses for efficiency. If you have any other suggestions, feel free to join the discussion below.

White summary Magazine

White summary Magazine